Revving Up Domestic Revenue Mobilization in Uganda

Lessons from Uganda’s Local Taxation Strategy for a Path to Sustainable Economic Development

Despite its recent economic growth, Uganda’s tax-to-GDP ratio has been lagging behind other countries in the Eastern and Southern Africa region due to inadequate and outdated tax collection policies and practices (see figure). With revenue figures hovering between 10 and 12 percent from 2011 to 2020, Uganda falls significantly short of the 17 to 19 percent range seen in other neighboring countries. This has contributed to insufficient social spending, resulting in a noticeable increase in income inequality over the past two decades. In fact, the pre-tax Gini coefficient, which measures income inequality, has risen from 0.39 in 1996 to 0.43 in 2019, indicating a 10 percent increase in public spending over a 20-year period.

Challenge

In today’s economic climate, finding new ways to generate revenue is more important than ever. However, African countries, including Uganda, face several obstacles in mobilizing property taxes, such as:

- High tax rates imposed during property transfers.

- An outdated tax base that fails to account for current market conditions.

- The erosion of the tax base due to exclusions, exemptions, and loopholes that apply to owner-occupied properties and new constructions.

- Existing laws that require expert valuations, even though tax authorities lack the necessary valuation skills and capacity.

- Unclear billing and collection practices that hinder the enforcement of taxation laws.

Given these impediments, there is an urgent need for innovative approaches to property taxation to improve revenue generation and ensure sustainable economic growth.

Solution

The U.S. Agency for International Development’s (USAID’s) Uganda Domestic Revenue Mobilization for Development project, implemented by Cadmus’ wholly-owned subsidiary, Nathan Associates, aims to strengthen local tax revenues in 10 Ugandan cities, including Fort Portal, Mbarara, and Gulu. The project achieved its goals through two stages:

In the first stage, the project streamlined communication between political authorities and local revenue authorities, designed domestic revenue improvement plans, and launched a campaign with civil society organizations to gain taxpayers’ confidence. As a result, the 10 cities witnessed revenue gains.

In the second stage, the project contracted three local firms to undertake professional property valuations using geospatial information system methodology. The new database showed 160,000 properties in the 10 cities compared to 20,000 in the previous paper-based records—an eightfold increase.

Results

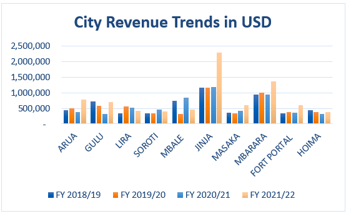

As a result of these initiatives, the 10 cities’ total revenue collection increased from UGX 20 million (US$5.4 million) in 2018/19 to UGX 28.9 million (US$7.8 million) in 2021/22. The project expects a 100 percent increase in revenues by FY 2024/25, with potential for further growth in subsequent years.

In early 2022, the project successfully valued and uploaded 160,000 properties in the 10 cities, representing an eightfold increase from the previous paper-based records of about 20,000 properties. As the cities continue to expand their tax base, the project expects a 100 percent increase in revenues from the 10 cities by FY 2024/25, with further potential for growth in subsequent years.

Key Lessons: The success of Uganda’s property valuation system offers a promising option for low-income countries seeking to strengthen their revenue base. By implementing a sustainable and transparent system of property valuation, the project has demonstrated the potential for similar reforms in other countries. This model can serve as a blueprint for other low-income countries looking to mobilize domestic revenues and achieve sustainable economic growth.

Read more in the Center for Global Development’s article, How Can Local Taxation Strengthen Domestic Revenues? Uganda Offers an Example