Beyond Cash—Moldova Embraces the Future of Payments with Pioneering MIA System

USAID MISRA Team Leverages Key Success Factors for Instant Payment Systems

Cadmus Company, Nathan, is supporting the USAID Moldova Institutional and Structural Reforms Activity (MISRA) project in an ambitious effort to modernize Moldova’s financial infrastructure.

In a bold move, Moldova has launched MIA, an innovative instant payment system platform enabling real-time fund transfers between accounts. This cutting-edge platform represents a major technological leap, ushering in a new era of fast, convenient digital payments across the country. The evolution of payments has accelerated rapidly worldwide, fueled by the convergence of finance and technology. The fintech boom following the 2007-2008 financial crises challenged traditional banks as numerous startups emerged. Widespread mobile technology adoption also drove this global transformation.

Despite fintech’s swift rise, infrastructure supporting the financial system was often sluggish to change. Processes like fund clearing and settlement remained relatively slow, with regulators and financial infrastructure operators lagging behind fintech’s pace-driven innovation. Nonetheless, there are signs indicating a turning point, as innovation gradually penetrates financial sector infrastructure.

The Global Rise of Instant Payment Systems

According to recent reports[1], instant payment systems, owned publicly or privately, have already been implemented in about 70 countries. These systems offer important advantages, enabling money to move instantly between accounts without traditional workday/hour constraints. For businesses, it can improve cash flow management at a lower cost compared to traditional methods.

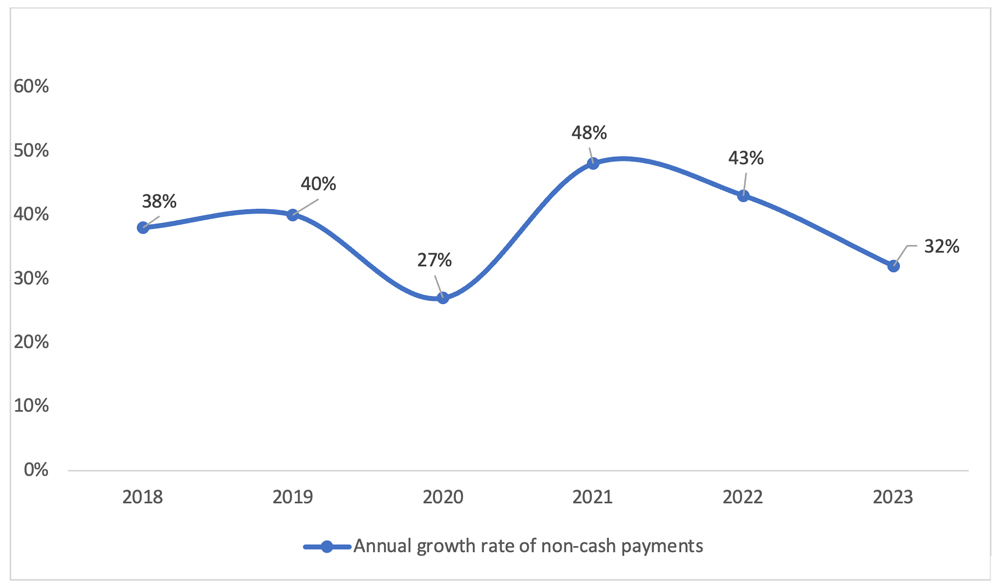

In 2019, Moldova’s National Bank (NBM), the national payments infrastructure owner and operator, decided to develop a national instant payments system. While card payments grew around 40% annually in the last decade[2] (see graph), over 50% of Moldovans still heavily relied on cash and ATM[3] withdrawals, providing impetus to improve payments infrastructure for greater financial inclusion.

Key Success Factors for Moldova’s MIA System

As technical implementation preparations began, NBM’s core team studied key success factors for instant payment systems in other countries, like Brazil’s Pix, India’s UPI, and the UK’s Fast Payments.

Several prerequisites for success in Moldova were identified:

- Regulatory: Mandatory participation for all banks and payment providers in Moldova’s automated internal payment system, ensuring 100% reachability with clear governance rules.

- Aliases: Allowing users to register phone number aliases linked to accounts for receiving payments.

- Fee structure: Incentivizing person-to-person transactions and system acquisition through strategic fees.

- Branding: A distinct brand separate from NBM’s infrastructure but flexible for adaption in mobile banking apps.

- Communication: Significant outreach efforts to raise awareness of the new brand, system, and services.

- User interface and experience: A comfortable, seamless user journey akin to modern fintech apps, ideally standardized across mobile banking apps.

While NBM leadership drove implementation momentum, achieving key success factors extended beyond its traditional scope, necessitating broader collaboration and expertise through the USAID MISRA program.

Between late 2022 until early 2024, MISRA supported NBM in complementary activities such as drafting governing rules, developing the brand identity, designing standardized user interfaces and experience, and assisting outreach efforts.

In March 2024, the highly anticipated MIA system launched to considerable acclaim, marking a significant achievement for NBM and the local financial market.

Initially, the peer-to-peer and request-to-pay services were offered free up to monthly limits to drive wide adoption. After just one month, over 100,000 of Moldova’s 2.6 million residents registered, with NBM and USAID MISRA aiming for 500,000 users (25% of adults) within the first year.

Upcoming plans include rolling out payment modules for businesses via QR codes, deep links, and request-to-pay, with USAID MISRA supporting three fintech grantees to develop related acquiring services. MISRA will also assist NBM in widespread communication and awareness campaign and enable MIA for tax/public service payments for the State Treasury via MPay.

Through pioneering MIA, Moldova now embraces an innovative, inclusive financial future, streamlining payments for citizens and businesses nationwide.

About USAID MISRA

The Moldova Institutional and Structural Reforms Activity (MISRA) is a five-year USAID-funded initiative designed to bolster Moldova’s sustainable and inclusive recovery following the regional crisis triggered by the war in Ukraine. MISRA goal is to catalyze enhancements in Moldova’s institutional, business, and trade environments. The program is dedicated to launch innovative efforts within the financial sector, including the introduction of new financial services and products aimed at facilitating trade, reducing costs, and creating new opportunities for Moldovan businesses. MISRA decided to support the NBM in rolling out a national instant payments system to boost financial inclusion, giving more people easy access to modern, quick payment tools. This effort aims to simplify daily financial transactions for everyone, making them faster and more affordable, which can help improve the financial well-being of Moldovans. By supporting this initiative, MISRA is also fostering the growth of advanced digital financial services that can lead to a more vibrant and inclusive economy in Moldova.

[1] https://www.mastercard.com/news/perspectives/2023/real-time-payments-what-is-rtp-and-why-do-we-need-instant-payments/

[2] https://bnm.md/bdi/pages/reports/dsp/DSP4.xhtml

[3] OECD INFE Survey Results obtained by MISRA. The national survey is representative of the population aged 18-75 from Moldova, excluding Transnistria. Collection method: CAPI. N=1024.